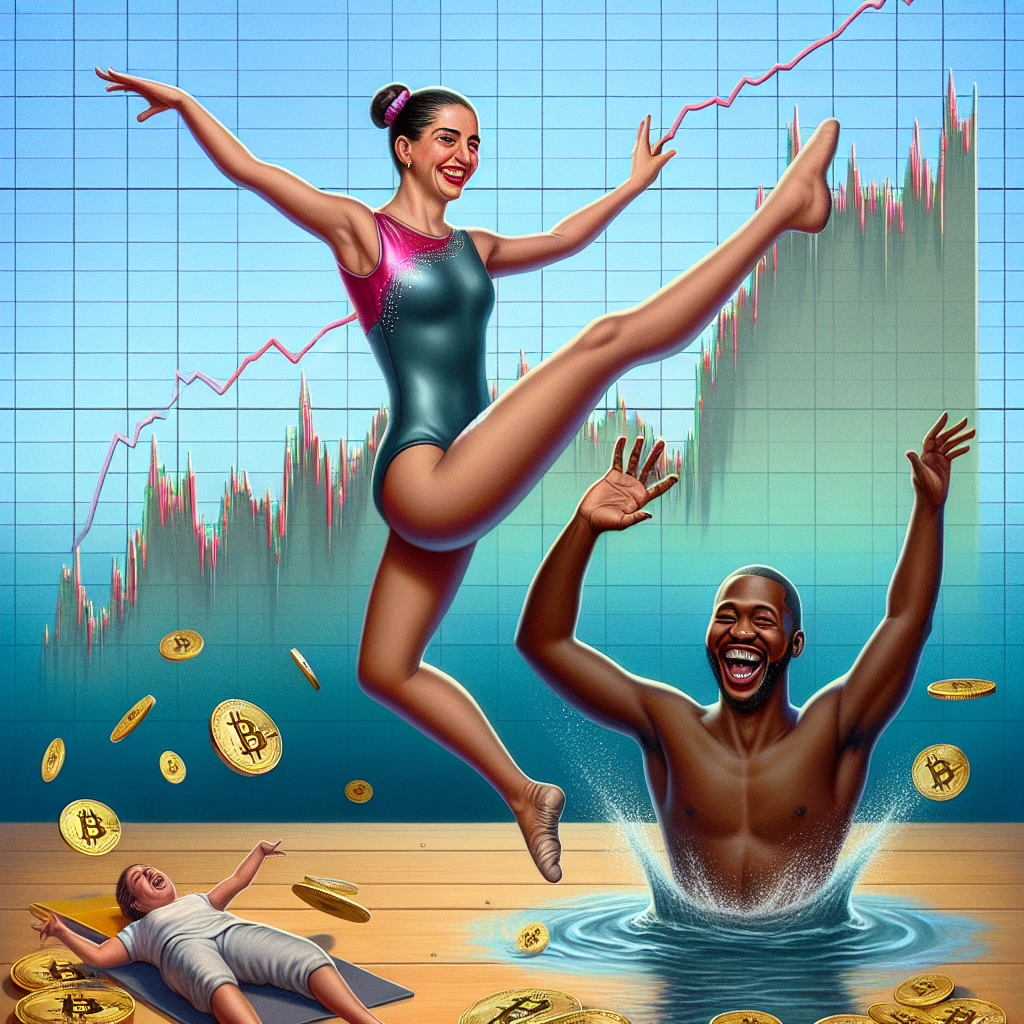

In the grand theater of finance, where stocks occasionally take a tumble like a clumsy gymnast, savvy investors are strapping on their financial seatbelts and taking a wild ride into the world of Bitcoin holdings. Yes, while your favorite tech stocks are doing their best impersonation of a sinking ship, Bitcoin is emerging as the confident swimmer in this financial pool.

Why Buy Bitcoin Holdings? A Golden Opportunity!

Imagine this: you’re at a yard sale, and your neighbor is practically giving away vintage vinyl records because they think they’re out of style. Do you look at them and say, “Oh no, I’ll pass”? Or do you think, “What a steal! I’ll take them all!” Investing in Bitcoin holdings during a stock market dip is much like that yard sale moment. When stocks prices drop, it creates a golden opportunity to grab some crypto gems at bargain prices.

The current economic landscape is challenging, with volatility dancing around like it’s auditioning for a reality show. But amidst all this chaos, Bitcoin has been showing resilience. It’s like that friend who shows up to the party when everyone else has bailed out—always reliable and ready to celebrate!

The Numbers Game: Bitcoin vs. Stocks

Let’s break down the numbers. According to recent reports (and our trusty calculators), Bitcoin has seen an impressive surge in adoption rates, while traditional stocks are experiencing their own rollercoaster ride. Data shows that as the stock market dips, interest in Bitcoin holdings tends to rise. Why? Because when the going gets tough, the tough get digital!

Investors are increasingly turning to Bitcoin as a hedge against inflation and economic uncertainty. In fact, many view it as digital gold—shiny, valuable, and significantly easier to store than that pesky metal bar you’ve been hiding under your bed.

The Emotional Rollercoaster of Investing

Investing can feel like a relationship sometimes: full of ups and downs, moments of joy followed by sheer panic. But let’s not forget about strategy! The key here is to remain calm and collected—like an experienced poker player who never lets their opponents see them sweat.

- If you’re contemplating diving into Bitcoin holdings, consider adopting a dollar-cost averaging approach. This strategy involves consistently investing a fixed amount in Bitcoin over time, regardless of its price fluctuations. It’s like sprinkling fairy dust on your investment—eventually, it adds up!

Market Sentiment: The Pulse of Crypto

The sentiment around cryptocurrency shifts faster than trends on social media. One day everyone is thrilled about Bitcoin reaching new heights; the next day it’s all doom and gloom because someone tweeted something slightly negative. Staying informed about market sentiment can help you make better decisions.

Platforms like Twitter and Reddit have become the town squares for crypto discussions. Just remember to sift through the hype—it’s easy to get swept away by rumors! Look for credible sources before making any investment decisions.

Staying Ahead of the Curve

So how do you navigate these turbulent waters? First, keep yourself educated about Bitcoin holdings. Understanding blockchain technology and market trends will help you become more confident in your investment choices.

Second, don’t be afraid to seek advice from seasoned investors or financial advisors who know their way around cryptocurrencies. They can offer insights that even Google might miss! But remember, every investment comes with risks—there’s no magic crystal ball here!

The Future Looks Bright for Bitcoin

In conclusion, while stocks might be taking a nosedive into the abyss right now, Bitcoin holdings could be your ticket to staying afloat. With its growing acceptance as an asset class and its potential for appreciation, investing in Bitcoin during stock dips makes perfect sense. It’s not just about riding the wave; it’s about surfing it with style!

- So grab your metaphorical surfboard and ride those crypto waves! And hey, if you have thoughts on this topic or want to share your own investment experiences with Bitcoin holdings, we’d love to hear from you in the comments below!

A special thank you to CCN for their original insights on this topic! Check out their article here.

Additionally, for those intrigued by the rapidly changing crypto landscape, check out our related articles on Crypto Inflows Top $11B but Global Investors Are Rethinking Exposure and Pakistan To Follow US Lead on Bitcoin Reserves, PCC Chief Confirms.